Trading Mathematics, The Only Edge for Marijuana Stock Traders

Ever see Rain Man? The movie where Dustin Hoffman plays an autistic man with a very high math IQ that allows his brother, played by Tom Cruise, to exploit his abilities by having him count cards in Las Vegas. You do not need to have an incredibly high math IQ to count cards in casinos, although it does not hurt either. What it takes more than anything else is the ability to focus your attention on watching the cards and keeping count. It is not so easy to maintain focus in a casino for any prolonged period of time though considering all of the flashing lights, bells and whistles, talking dealers and cocktails. The act of counting cards is also against casino rules and if they catch you, they will throw you out.

John W. Henry

John W. Henry

It supposedly happened to one of the most famous investors in the world, John Henry, the owner of John W. Henry & Company, an investment management firm that stopped managing client funds in 2012. In a paper he wrote while attending UCLA he claimed that he went to Las Vegas and was thrown out for effectively counting cards. Also, early in Mr. Henry’s life he encountered forward contracts, a very close cousin to futures. While risky, one of the advantages to futures contracts is that you can short them just like you can buy them. In other words, the futures markets do not have the bullish bias that stocks do. Not to say that you cannot short a stock, but the exchanges do not make it as easy as buying or going long a stock. Whereas with futures, they allow traders to do either because it is an essential aspect of the nature of the assets. When John Henry realized that in futures he did not need an uptrending market all of the time to have the potential of making money, that he could make or lose money just easily in a down market as an up market, he had an idea based off of relatively simple math. He also realized they would not throw him out for using his math skills in futures.

While a casino does not permit the effective use of mathematics to count cards, it is allowed in the exchange traded markets. There are many practices in stocks that are illegal like using insider information to take positions or a company fudging their numbers to make their stock seem more appealing to investors. But a trader using their ability to focus and use basic math is permitted and it is the one edge in trading the markets that is not allowed at a black jack table. In my opinion it is the only actual edge and most people do not use it. Maybe traders do not use their mathematical edge because they do not know how to, maybe it is because they cannot focus for long or maybe it is simply that they are so caught up in the excitement of potentially making money that they do not care to turn it into work by creating a mathematical discipline. It is this mentality unfortunately that so commonly has investing and trading compared to gambling. If you do not utilize the mathematical edge you have in stocks than you may just as well go to a casino.

The lure of volatile assets like marijuana stocks is the volatility. The big sudden swings where a lot of money exchanges hands frequently is why there is an opportunity in penny stocks, futures and cannabis companies. The volatility means though that you need the mathematical discipline more than ever. Marijuana stock traders also do not have the edge of being able to short marijuana stocks just like they can buy, the additional edge that John Henry identified in futures all of those years ago. Being able to short the stock allows for twice the amount of opportunity to take advantage of the volatile price swings. That missing variable is another reason why a mathematical discipline is so necessary when trying to make money trading marijuana stocks.

Again, the math is not all that hard, it is maintaining focus and staying with the discipline over time that is the true difficult part. There are all sorts of indicators out there to allow a trader to identify potential support or resistance. None of them are right or wrong, meaning they could be right or wrong at any given time. They are simply the structure for which a trader must build their discipline. So, if you like Bollinger bands, Fibonacci retracements or extensions, Elliot wave analysis, moving averages, average true ranges, volume analysis or any combination of them and the myriad of other ways to conduct analysis on a stock, then great, just pick something. Stick to it and test it through paper-trading or if that is not exciting enough just trade small amounts of money to test it. The key is determining your risk thresholds. The difficult math has already been done for traders by being built into the indicators.

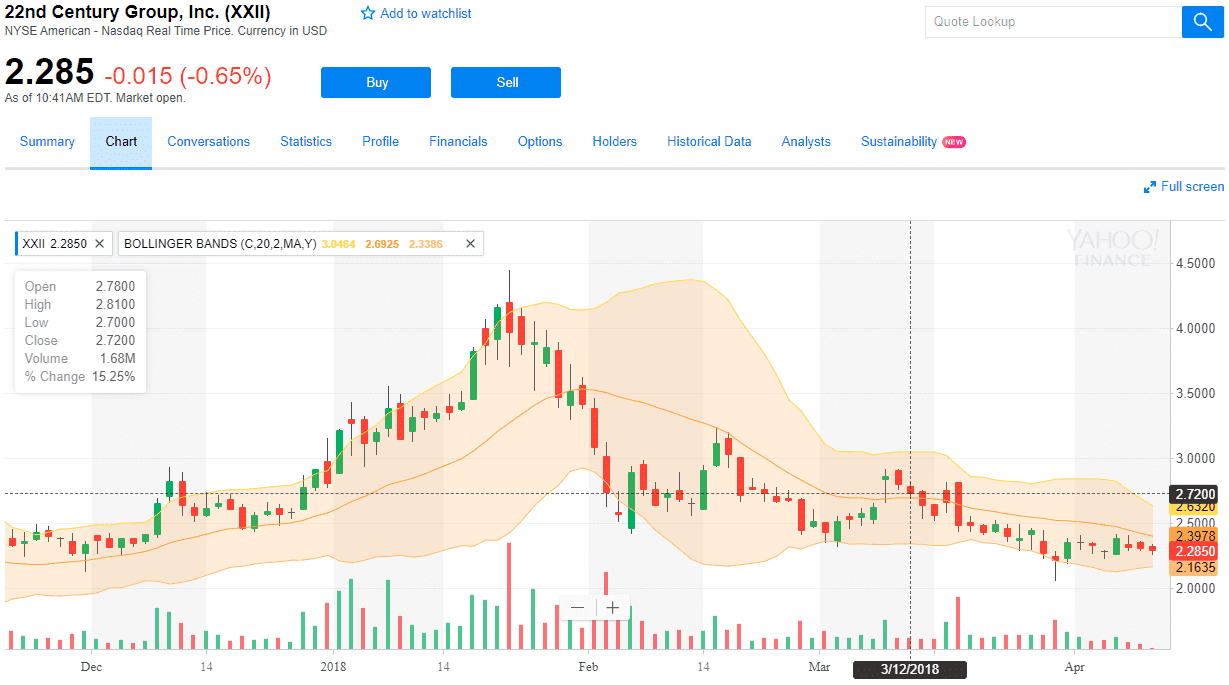

Let’s say that a trader decides they are willing to risk 10% on 22nd Century Group, Inc. (NYSE: XXII), a biotechnology company that reduces cannabinoid content in cannabis plants for producers. If the stock is trading at $2.28 and the trader is willing to risk 10%, well 10% of what? Is 10% then .23 cents, $2.28 x .10 = .228 or .23 cents. So the trader puts a stop order at $2.05, .23 cents below $2.28, but how many shares of the stock do they own so they know exactly what a .23 cent loss would amount to. If they own 1,000 shares of XXII then the loss would be $230, if they owned 10,000 shares then it would represent a $2,300 loss. That begs the question, well what kind of percentage loss is that to the account? How big is the account in total? Are they working with a total of $10,000? If they own 100 shares of XXII and take the $230 loss then that represents a 2.3% loss to the account. If they own 10,000 shares that represents a 23% loss to the account. A 23% loss to an account on one position is not mathematically feasible. If a trader took two losses like that they would have nearly seen a 50% decline in their account which would then take a 100% return just to get back to break even. Does that sound reasonable? Remember, the S&P 500 lost more than 50% in the 2008 crash and did not get back to its 2007 high until 2013. That was six years of an investment life that cannot be returned and as rebounds after a crash go, six years is fast. While I will not go into detail right now about the value of compounding, suffice it to say that six years is too much of a sacrifice for an investor to give up.

Losses need to be kept small. If when looking at XXII a trader decides that the recent dip is a good buying opportunity and also believes that either the March 28th low of $2.05 or one standard deviation below the 20 dma at $2.12 is support (where the lower Bollinger band is in the above chart on April 5th), that is fine. They are both approximately 10% away, but pick the $2.12 since it fits the discipline of risking 10% or less of the stock. Then think about how many shared to purchase so that the position represents a reasonable risk to the portfolio. On a $10,000 account that would be best represented by no more than 1,000 shares so the maximum loss to the account on the single position represents 2.3%. Let’s say the trader sticks to this discipline and picks up a total of 10 different marijuana stocks risking approximately 2.3% on each of the positions. Now, let’s say that all 10 positions lose the maximum amount of 2.3%, so a total of 23% which would represent a $2,300 loss to the portfolio as a whole. The trader is not happy by any means, but it is not a 50% loss that would now require a 100% return to get back to break even. What is the likelihood of losing on all ten positions anyways? It definitely happens, but the simple laws of averages makes it an unlikely outlier. Let’s say just one position makes a profit of .23 cents, then that is the equivalent of only losing on eight of the positions, which brings the loss to the portfolio down to 18.4% or $1,840 on a $10,000 account. If half the positions made .23 cents while the other half lost .23 cents then the portfolio is at break-even minus trading fees.

Let’s take this just one step further. Many trader are obsessed with having more winners than losers which does not hurt but also does not mean they are net profitable. Conversely, a trader could have more losing positions than winning positions and be net profitable. If If a trader buys 1,000 shares each of ten different marijuana stocks at .50 cents/share and six of the positions climb to .75 cents a share, which would be a 50% return and result in a 15% gain to the portfolio or $1,500. But, what if the other four positions experience a 100% loss which would be a .50 cent loss on each 1,000 share position equaling $2,000 and a net result of a 5% loss to the portfolio or $500. If that trader had simply focused on their risk thresholds and exited each of the positions at .25 cents, their account would now have a net 5% gain instead of being down 5%. You see this math is not hard, we are not talking rocket science here, but very few traders think this way. When you think about trading mathematically just like John Henry did counting cards in Las Vegas and now does with baseball statistics as the primary owner of the Boston Red Sox who won three world series since 2004 after going through an 86 year drought, then trading comes into a whole new light.

Let’s take this just one step further. Many trader are obsessed with having more winners than losers which does not hurt but also does not mean they are net profitable. Conversely, a trader could have more losing positions than winning positions and be net profitable. If If a trader buys 1,000 shares each of ten different marijuana stocks at .50 cents/share and six of the positions climb to .75 cents a share, which would be a 50% return and result in a 15% gain to the portfolio or $1,500. But, what if the other four positions experience a 100% loss which would be a .50 cent loss on each 1,000 share position equaling $2,000 and a net result of a 5% loss to the portfolio or $500. If that trader had simply focused on their risk thresholds and exited each of the positions at .25 cents, their account would now have a net 5% gain instead of being down 5%. You see this math is not hard, we are not talking rocket science here, but very few traders think this way. When you think about trading mathematically just like John Henry did counting cards in Las Vegas and now does with baseball statistics as the primary owner of the Boston Red Sox who won three world series since 2004 after going through an 86 year drought, then trading comes into a whole new light.

So, whether you are into using Fibonacci ratios or Gaussian distributions, fine. They both make a lot of sense, but the sense they make is a mathematical which applies to anything with enough data points whether they are the amount of students in a class, the amount of red spotted newts in vernal pools, the swirls in snail shells or the myriad of stocks and price points they have reached. If a trader does not identify that the technical analysis they are utilizing is mathematically based and they in turn must use math to effectively use the indicators, then they are treating the market just like someone sitting at a black jack table wowed by the jackpot sirens, the dealer’s funny stories and the free drinks.

So, whether you are into using Fibonacci ratios or Gaussian distributions, fine. They both make a lot of sense, but the sense they make is a mathematical which applies to anything with enough data points whether they are the amount of students in a class, the amount of red spotted newts in vernal pools, the swirls in snail shells or the myriad of stocks and price points they have reached. If a trader does not identify that the technical analysis they are utilizing is mathematically based and they in turn must use math to effectively use the indicators, then they are treating the market just like someone sitting at a black jack table wowed by the jackpot sirens, the dealer’s funny stories and the free drinks.

Facebook Comments

Tags

22nd Century Group Inc.Bollinger bandsFibonaccifuturesGaussian DistributionJohn W HenryJohn W. Henry & Companylatest cannabis newsmarijuana stocksmathematicsNormal Distributionrisk thresholdstechnical indicatorstrading disciplinevolatilityXXII