Marijuana Stocks, Isolating Ranges in Scotts Miracle-Gro

This review is focused on isolating ranges in an equity’s chart and Scotts Miracle-Gro (SMG) is the example only because it is a very liquid asset that went public in 1992 and has a market capitalization of approximately $5.203 billion. The additional liquidity and time relative to other marijuana stocks simply provides more data points to make the highlighting of ranges more clear. Although, I do know there are plenty of people out there that do not want Scotts Miracle-Gro grouped with other marijuana stocks.

The entirety of the marijuana industry is controversial considering cannabis is a Schedule 1 substance making it federally illegal, there are still many people that see it as nothing other than a gateway drug and the current attorney general (Jeff Sessions) is just angry about it. But, I begin with this preface because if we look even further into the industry, Scotts Miracle-Gro is basically hated by most people involved in the cultivation of legal marijuana. Let me offer a brief explanation why before reviewing technicals.

Jim Hagedorn, CEO Scotts Miracle-Gro

Jim Hagedorn, CEO Scotts Miracle-Gro

Scotts Miracle-Gro started a subsidiary called Hawthorne Gardening Company in 2014, which is their marijuana division. But, it does not grow or sell marijuana which means they are avoiding a lot of the risks that cultivators are taking. It is run by Scotts Miracle-Gro CEO Jim Hagedorn’s 32-year old son, Chris Hagedorn. Since 2015, they started buying up cannabis companies like General Hydroponics, Vermicrop Organics, Gavita Horticultural Lighting, American Agritech (known as Botanicare), Can-Filters Agrolux, Fafard, Black Magic, Whitney Farms, Root Farm and Ecoscraps. They brought corporate America tactics to the burgeoning cannabis industry that many of the entrepreneurs in the industry had no way of keeping up with. The interpretation of many cultivators is that Scotts Miracle Gro is monopolizing the technology industry for indoor growing, forcing indoor cultivators to buy from them.

Beyond Scott Miracle-Gro’s big business way of doing things, the other problem that many of the people in the cannabis industry have found with them concerns their business practices. Many of the people in the cannabis industry are environmentalists, green is the color that identifies both marijuana and the environment after all. The biggest point of contention is with the product Roundup. Scotts Miracle Gro has the rights to the weed killer because they partnered with the chemical manufacturer Monsanto, who is also the creator of Agent Orange. Roundup is a glyphosate-based chemical that has been sprayed throughout the United States, Canada, Europe, South America, Central America and China. It seems the product is sold nearly everywhere and not only kills marijuana plants, but is bad for the rest of the environment and people as well. Look at this funny video of Patrick Moore, a Monsanto “supporter”, try and tell a French journalist that Roundup is safe for people to drink.

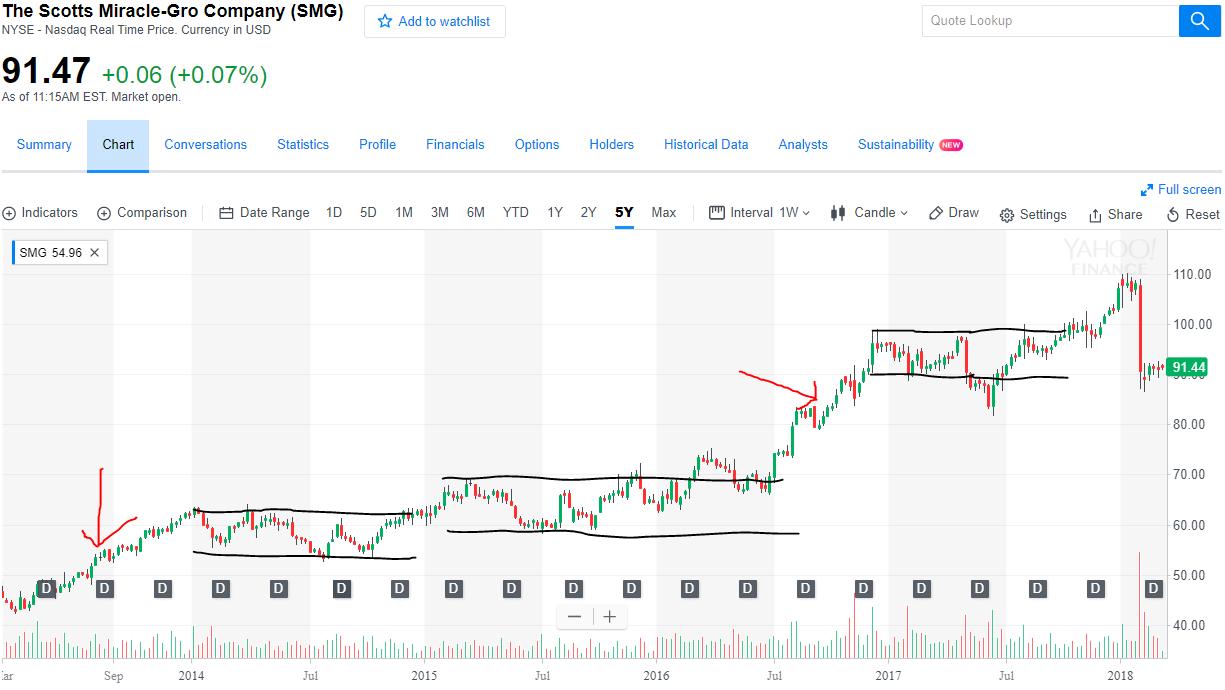

Now that there is some background on Scotts Miracle-Gro, let’s take a look at what has been happening with the stock. Take note of the 14% selloff on January 30th of this year and the massive gap down. Quarterly results were particularly bad, even though for a lawn and garden company the first and fourth quarter results typically are not good due to winter time weather. Year-over-year though, the $1.08 loss per share was considerably more than the $0.88 loss per share from 2017. It made investors very unhappy which caused the stock to drop all the way below its 200 dma which is not a good sign. We have seen a pick up in short selling volume as well.

Unlike the rest of the sector, illustrated by the Horizons Marijuana Life Sciences ETF (HMMJ.TO) seen below, Scotts Miracle-Gro not only broke below its 200 dma but there has been no real recovery and its 200 and then 50 dma are likely to serve as strong levels of resistance. You can see below how much of a challenge it has been for HMMJ to get back above its own 50 dma.

When you look at the five-year chart of Scotts Miracle-Gro below, there are quite a few things to acknowledge when looking at the isolated ranges. First off, can you see how often the market is in a range? This is not just true of SMG but of any market. They spend roughly 80% of their time stuck in ranges. What does this mean? It means that the opportunity for growth for most investors or traders happens the minority of the time. When a market is trapped in a range, the only traders out there that have any possibility of making money during these periods of time are extremely short-term traders. To be successful as a short-term trader, they need to be constantly analyzing and managing risk. It is beyond the scope of most traders or investors’ abilities.

Understanding that markets are stuck in ranges as often as they are allows investors to gain a bigger picture perspective on how their portfolio could potentially grow over time. Growth happens in short term bursts, followed up by long periods of stagnation and then the occasional massive loss. It is simply the way that it goes no matter how much an investor gets frustrated by investments that have not been performing as well as they might like over a six month, year, or possibly even longer period. Scotts Miracle-Gro virtually did nothing from 2014 until mid 2016, but noone is going to look at this chart and not see a stock that has been in a solid long-term uptrend. If you we look at the cannabis sector as whole, none of the companies have as much liquidity or time as SMG. In other words, this is as stable of a stock as anyone is going to find for now in the cannabis sector.

These isolated ranges also let a trader better identify levels of support and resistance. Notice that while the recent selloff in SMG is now well below its 50 and 200 dma, in all reality what it has done is fallen back down into the range of 2017. Clearly the bottom end of the range of 2017 is serving as support for SMG. If this level of support is broken though, the next stop is all the way down to the $60 – $70 range of 2015. That would be a $21.44 drop to $70 per share and represent over 23%. Just how much money should an investor be willing to give up when it has taken so long to find the growth that also came with a great deal of anxiousness?

Facebook Comments

Tags

Hawthorne Gardening Companyisolated rangesJim HagedornMonsantoRoundupscotts miracle-groSMGsupport and resistance