Legal Marijuana Tax Revenue: Where Does the Money Go?

Since the legalization of marijuana in January 2014, Colorado has collected more than a half-billion dollars in tax revenue from sales of medical and recreational marijuana.

The state reached that mark in May, but a report by VS Strategies in Denver, on data from the Colorado Department of Revenue, wasn’t made public until Wednesday, KDVR reports.

According to the company’s report, sales totaled $76 million in 2014, $135 million in 2015, and then $198 million in 2016.

Sales have already hit $96 million as of May of this year.

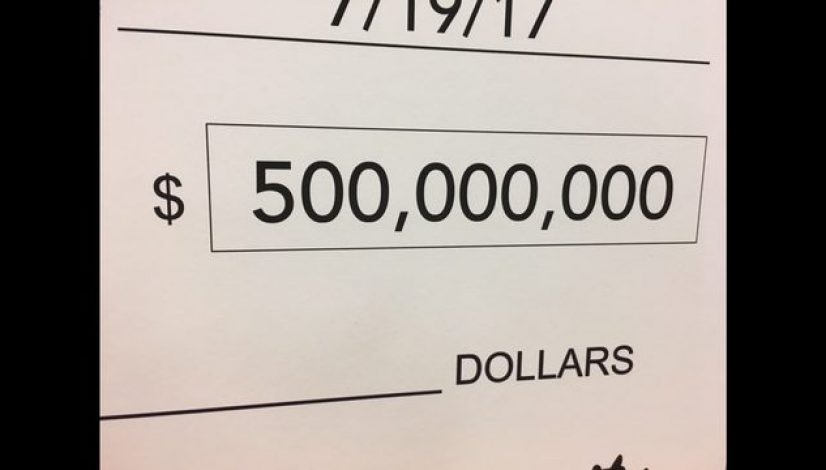

VS Strategies presented Rep. Jonathan Singer, D-Boulder, with a check for $500 million Wednesday. The company helped write the bill that lawmakers passed to allow recreational marijuana.

According to the report, 51.3 percent of the funds have been spent on school construction, while most of the remaining money supports programs tied to mental health, substance abuse and criminal justice.

“Our top goals are that recreational marijuana pays for itself and that schools are the primary benefactor,” Singer said. “The legislature chose other recipients because they’re in the most need and usually are underfunded by other sources.”

Southern Colorado has received at least $3 million of the revenue. Much of that went to Pueblo County for marijuana research at Colorado State University-Pueblo and for a program providing college scholarships to 210 local students.

“A half-billion isn’t much when it’s spread across the state,” Singer said. “But we’re doing what we can. The common myth is we spend some of it on roads. We may do that in the future.”

The revenue allocations include $7 million to local communities that have yet to allow recreational marijuana sales, and use the money to offset negative impacts of sales in surrounding communities.

“Local governments are free to assess their own marijuana taxes,” Singer said. “But voters have to approve it.”

Pueblo County levies a local tax, he said, while Manitou Springs remains the only municipality in El Paso County allowing recreational marijuana sales.

Recreational marijuana provides the majority of tax revenue because it’s taxed at a higher rate: a 15 percent excise tax, a 10 percent special sales tax that increased to 15 percent on July 1 and a 2.9 percent state sales tax that ended July 1.

Medical marijuana is assessed a 2.9 percent state sales tax.

License and application fees for dispensaries are included in the revenue formula.

Singer said lawmakers want to avoid the temptation to raise taxes even higher.

“I think we have a very responsible rate right now,” he said. “You don’t want to fuel a black market we’ve been trying to stamp out for the past four years.”

For more details, visit http://mail.npgco.com/service/home/~/?auth=co&loc=en_US&id=290225&part=2 or https://drive.google.com/file/d/0B9eaXW7_92zSUHBObVNsOUJOS2M/view.