Leading Indicators and Sectors of the Market

It is a little challenging to identify leading indicators for the cannabis sector of the market due to how young and undeveloped of a market it is. It seems pretty correlated to the overall market, so perhaps we can use the same old leading indicators your typical analyst would use for traditional investments. Of course, leading indicators are not able to predict where other markets will go, nothing can do that. However, leading indicators can be a nice addition to other forms of analysis to provide a clearer big picture.

There are many types of leading indicators, something as simple as an exponential moving average is a technically a leading indicator. The MACD or a stochastics oscillator all count as technical leading indicators. An investor could look at job numbers or the amount of new orders coming in from manufacturers to look at some fundamentals. I tend to want to make this all a little more simple.

I have mentioned ETFs in the past for their ability to provide diversification for an investor but at potentially much less costs in fees than mutual funds. They also make managing your investment portfolio much easier than having a hundred different companies that are nearly impossible to analyze thoroughly enough on a regular basis for most people. Another great function of ETFs is that they can serve as benchmarks for entire asset classes or sectors of the market. I became fond of looking at some of the sector ETFs to simplify leading indicator analysis. We have reviewed Horizons Marijuana Life Sciences ETF (HMMJ.TO) in the past but now we are going to look at some mainstream ones.

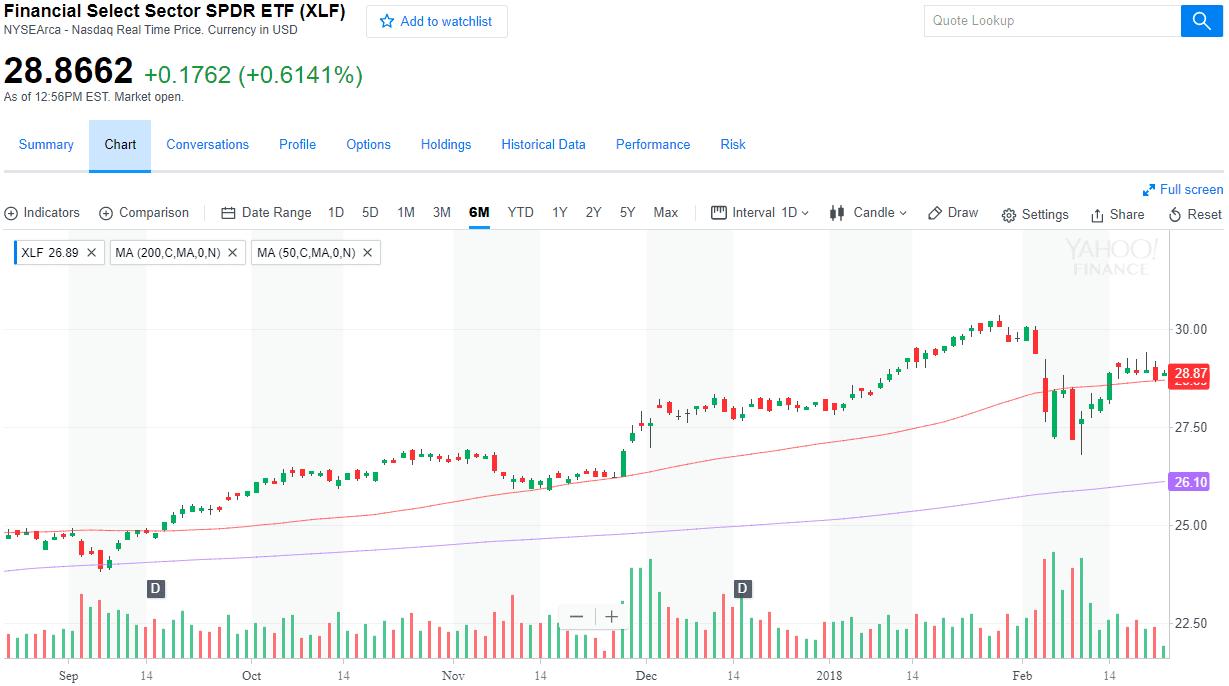

Let me give some background color to leading indicators. Most of the companies we see trading in the stock market are very dependent upon their ability to get loans from banks. They do not have enough net revenue coming in to pay for all of their projects and their plans for expansion. As long as the company has good credit, the banks are more than happy to keep collecting their interest. The only other reason why a bank may second guess giving out a loan is that the bank itself is suffering. Banks know when they are having some sort of internal problems and will start denying loans before their struggles are represented by their share price. But, when banks across the board stop giving out loans, that means there is some sort of macroeconomic issue and all of their clients are likely suffering too. Often, not always, the financial sector of the market will be the first to improve after the overall market has been suffering or the first to start to decline when the market is peaking. I like to look at the Financial Select Sector SPDR ETF (XLF) to see how the overall financial sector of the market is doing.

You can see that right now the financial sector is doing well. It did dip below its 50 dma but broke back through it and now it is serving as support. We will see that is a common theme as we continue to look at other leading sectors.

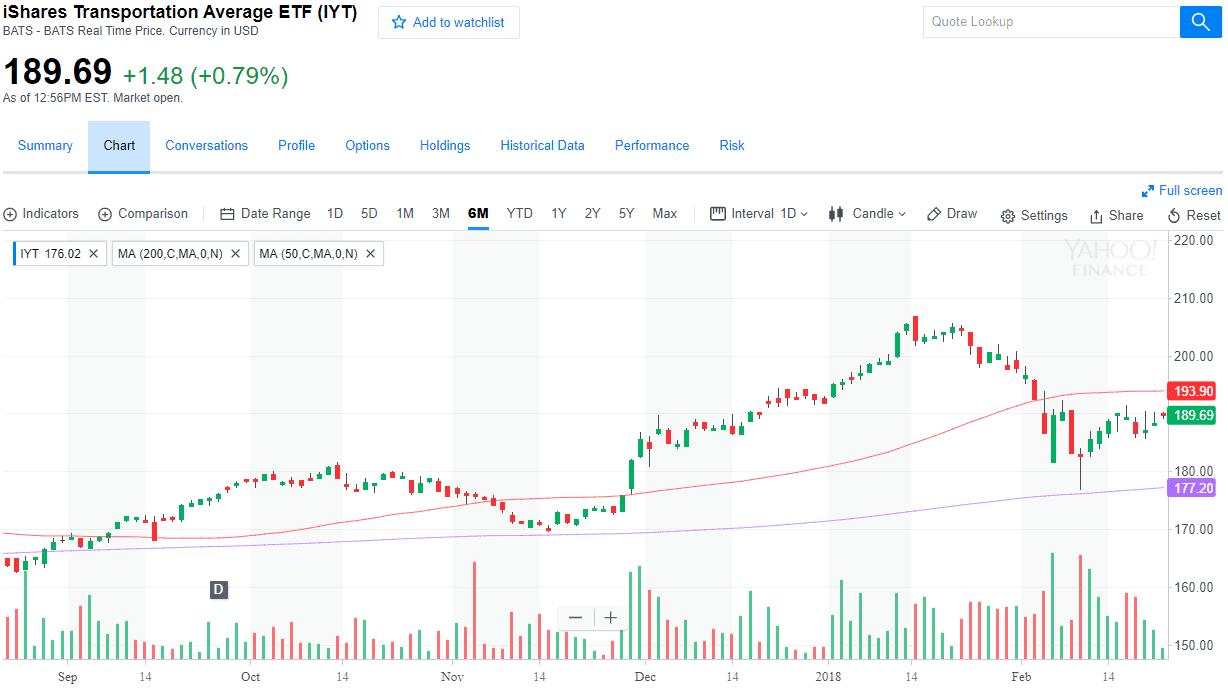

The transportation sector is also another good area to analyze. Many companies are dependent on couriers like Fedex and UPS to deliver their goods. Before an investor sees that a producer of some sort of product is struggling by analyzing its stock price, they may see those struggles reflected in courriers instead. When business is slowing, businesses slow down in using courriers and therefore the courier starts to struggle before its clients do. They may also improve first. I like to look at the iShares Transportation Average ETF (IYT) for transportation companies.

You can see that IYT has not been able to break back up over its 50 dma. It does not mean that it will not, but the transportation sector is something to keep a close eye on. A break below its 200 dma would be a very bad sign. You can see it tested the 200 dma briefly in early February.

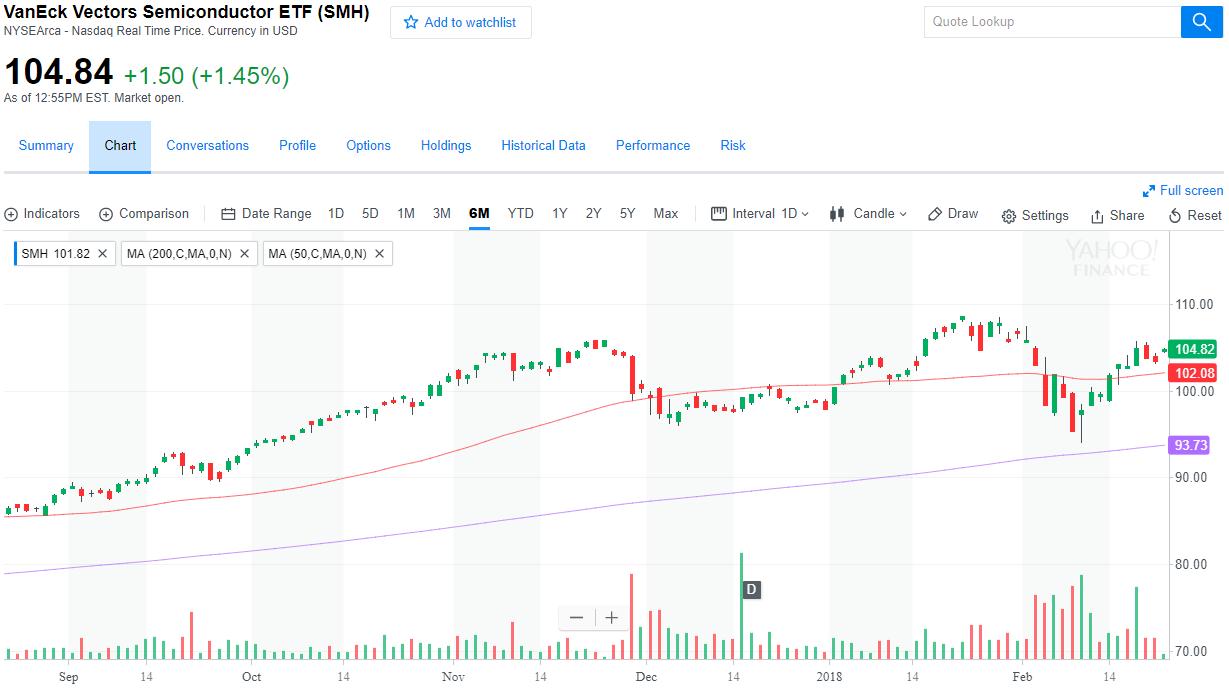

The last sector that I will mention as a leading sector of the market are the semiconductors. Companies need computers, they need them regularly and when computer sales slow, that is a bad sign for the overall market. The ETF I like for semiconductors is VanEck Vectors Semiconductor ETF (SMH).

Like the financial sector, semiconductors have rallied back above their 50 dma and are using it as support.

As of right now, based off of these indicators, I am not terribly worried about the recent correction in the market. It does need to be monitored closely though. Breaks through the 200 dma could be a super bad sign for the overall market and drag cannabis stocks down with it.

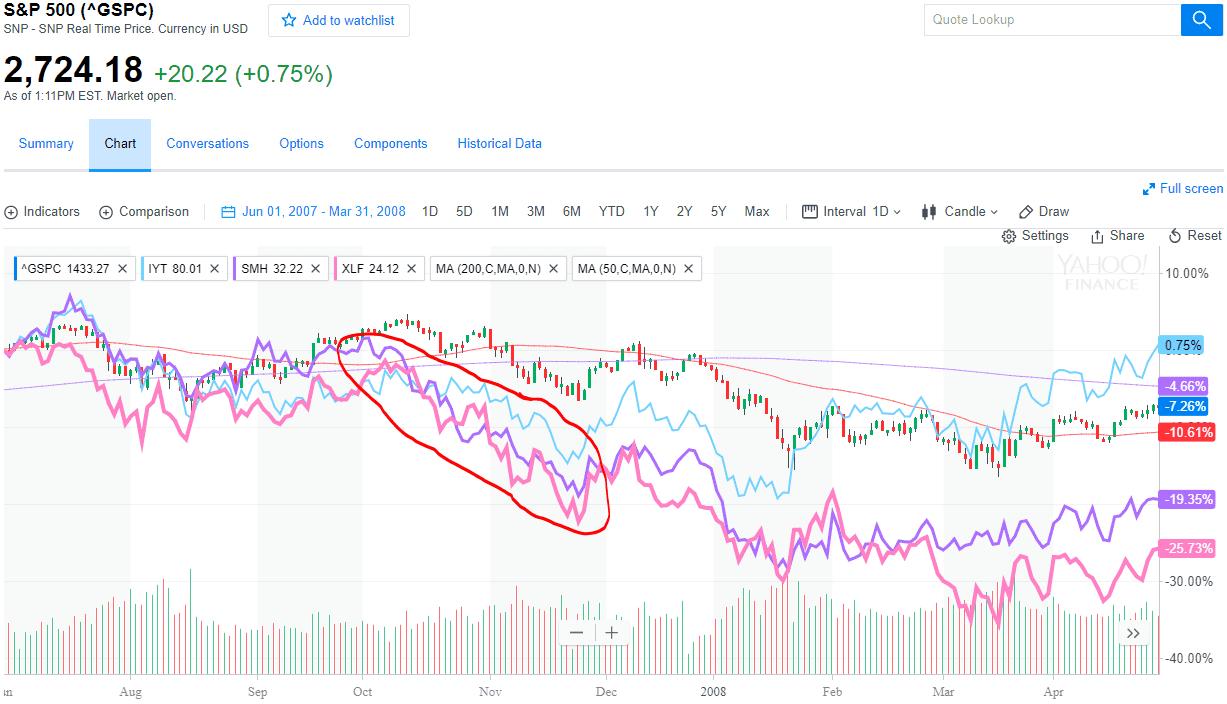

Take a look at this. It is a chart that shows the S&P 500 index along with XLF, IYT and SMH at the end of 2007 and the beginning of 2008. It represents the end of the incredible climb back out of the hole the dot com bubble left behind and the beginning of the subprime mortgage crash of 2008 that represented more than a 50% drop in the stock market.

You can see that at the end of 2007, all three of the leading sectors we have reviewed were breaking down well below their 200 dma before the market S&P 500. A break below the 200 dma for these sectors does not mean that everything is going to fall apart immediately. You can see they broke below the 200 dma before the red encircled area, but did not collapse right away. A break below the 200 dma is a really bad sign though and the markets need to be monitored very closely. Strong signs of recovery need to be seen before an analyst can settle down at all.

What does this have to do with the cannabis sector? Again, I mentioned the tight correlation that seems to exist between the HMMJ ETF and the market as a whole. The transportation sector will not matter as much for now due to the Schedule 1 status of marijuana and the inability of couriers to cross state lines with cannabis. The banking sector will not matter as much either for the same reasons, banks are unwilling to help out most cannabis businesses due to cannabis being illegal federally. Semiconductors though may be an important sector to watch. Cannabis companies not only use computers, but some of them use very advanced technologies in their grow houses. Most states also mandate a strict seed-to-sale monitoring program that a cannabis company would need to use. A cannabis company is not going to want to notify the world of their business slowing down until they have to, but their struggles may be reflected in their lack of purchasing electronics.

It may be great for many people that the prohibition of marijuana may be in the process of ending. However, a cannabis business may worry that their industry is being born during all time highs for the overall market. Today, the market has a whole lot further to fall than it did in 2008. All investors need to keep an eye on the overall market. Along the way, leading indicators can be used to analyze short term trends as well, even though this article is covering a longer term picture to provide comprehension of leading indicators and why they are worthwhile for analytical reasons.

Facebook Comments

Tags

financial sectorIYTleading indicatorssemiconductor sectorSMHtransportation sectorXLF