Charles Moon: When Will Cannabis Stocks Rally Again?

The cannabis sector washout or pullback has frustrated traders and more importantly investors alike. I want to point out a few things to help ease your mind and give you a bit more of an idea on your approach to this sector itself.

The cannabis sector washout or pullback has frustrated traders and more importantly investors alike. I want to point out a few things to help ease your mind and give you a bit more of an idea on your approach to this sector itself.

I normally offer up commentary articles regarding trades and trade setups. At the end of this I will toss in one entry I am looking at, but I feel the more important topic is regarding trading and investing psychology regarding the cannabis names.

When I peruse a lot of the trading groups on several social media sites lately, it is generally people asking where a bottom of a cannabis stock will be or if the pullback will sustain in these names. Generally speaking, the natural behavior of stocks will be up and down. An uptrend is defined by higher highs and higher lows. That means the stock pulls back but remains higher than the previous dip. Another point of discussion I hear a lot about is buying AFTER the news regarding the sector. Historically, the actual news event has been a reason to take risk off. I want to remind folks that while this is still a budding sector (pun intended), there are institutional interests and activity. Due to trading firms and banks generally taking large sized positions built over time, the big money traders need the liquidity to cash out on profitable trades. The best time for liquidity will be the news driven events and unfortunately, the news has been a reason for the fat cat bankers to use you to cash out. Sorry but that is the simple and cold truth.

The reason for my articles is to help traders be more informed. Investing in the sector is a completely different approach and really is much more a leap of faith. While we can gauge names on current valuations and numbers, the majority of investors are buying in on projections. Research all you want but the majority of the time they just don’t add up. Because this sector is also brand new and just starting to really garner a lot of retail and institutional interest, the swings in the cannabis names will be much more dramatic. If you invest in these names, you must focus on the long term picture. You must have the capital to park into these names for the much longer term light. Think about how long it took AAPL, NFLX and others to get to their current valuations. This is important to keep in mind. Not to freak out on any pullback or to pull your money out on the dip. The price fluctuations are a natural behavior in stocks and are a bit more dramatic in the cannabis names. However, this sector continues to bounce back. The dips are getting smaller and smaller and buy side activity continues to ramp up on the pullback.

Now some of you may say “I already know all about this” but I bet the majority of you did not. Personally I get excited when names like Cronos, Canopy, Aphria or Aurora pullback. For the investors, it is a value buy or an opportunity to build up your position. For the traders, there are short term swing plays on breakouts. I personally look for a recurring pattern to take the trades on. If you have followed me closely with these articles, my success rate has been pretty good.

Keep in mind that the sector is poised for a big jump. I can fathom a move like we saw at the end of 2017 if not larger. In fact, this can trump any move the sector has seen leading up to Canada going fully recreational. I suspect that around mid-late July we can see a high level of demand from buyers. I think at the latest we can see the demand come in is early August. I feel now is the time to really look closely at the bigger names. The smaller cap names can move in sympathy with the sector, but the broad move will be led by the big 4. That is where my attention is at the moment and I want to give you one trade signal that hasn’t triggered yet.

Now for full disclosure, I am currently long $CRON and $ACBFF on swing buys for my trading room. I obviously like these names and there is one more I am watching closely. The other will take a few sessions to properly align but expect that to come in the next article. Today I will talk about $CGC and the Inside Bar trade.

Canopy Growth Corporation

Canopy Growth Corporation

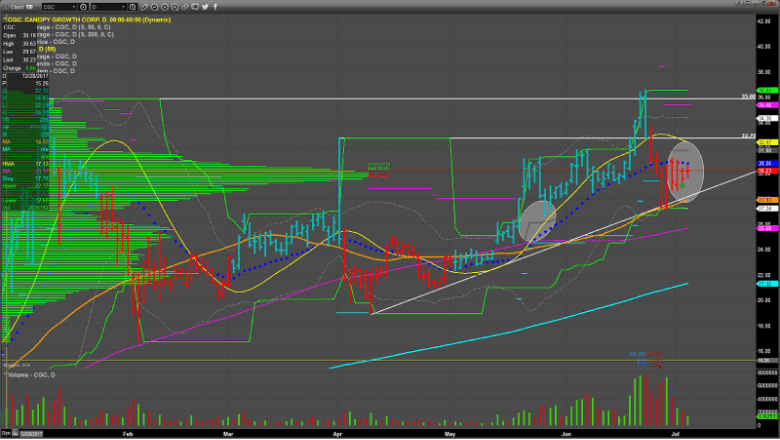

This is a Daily chart on $CGC and I highlighted the most recent trading sessions. The stock is in a consolidation mode and I have a particular set up called the “Inside Bar” that took place on the 3rd of July. An “Inside Bar” is when the stock trades inside the previous days range. Basically, the stock had a lower high price than the previous sessions and a higher low price also. I am looking for the stock to exceed the Inside Bar HOD (High of day) by 1% to trigger. Now that price will be $30.65, but there is a little tricky catalyst here. The blue dots are the 20 period Simple moving average. When the bars were blue, you can see that technical support was found at that given price range. Now we are seeing some technical resistance or a short term ceiling cap on the stock price. It is extremely important that you wait until the stock gets above the key technical level which is at $30.80 at the time of this article. You can front run and buy at the $30.65 price once it gets traded, but not until the stock trades that price by Monday July 9th. If it does not trigger by then, the signal is no longer valid. This is important because if you jump the gun on an invalid signal, it is more of a coin flip and I am not one to ever gamble on coin flips. My preference is that the signal triggers and gets above the $30.80 price before I buy, just so I can get actual confirmation on strong, bullish behavior. Your stop would be placed at 27.89 based on my methodology. I always define my risk with every signal I take. You won’t be right every time you trade so it is important that you have a plan and a max risk drawdown. Otherwise you may get stuck in a position where it continues lower and never recovers. That is when a small loss turns into an account killer.

Now you may ask, “if he is so bullish, why would I need a stop if the stock is going up anyways?” To that I answer, you just never know what news may come out. You never know what may happen with the companies management. That goes for any trade in any name, regardless of who they are or what they do. As an investor, just know what you have to deal with and have tempered expectations regarding the ups and downs for the time being. It is a long marathon and not a sprint. You must understand that you have to be in this for the long haul. You should also be buying on value and not euphoria. Leave the euphoria buying to traders like myself.

Find out more about Prosper Trading Academy and Charles Moon here: https://goo.gl/WE4Xkk

TNM News Corp. is not an investment advisor, we have no access to non-public information about publicly traded companies, and this is not a place for the giving or receiving of financial advice, advice concerning investment decisions or tax or legal advice. We are not regulated by the Financial Services Authority.

We are an educational forum for analyzing, learning & discussing general and generic information related to stocks, investments and strategies. No content on the site constitutes – or should be understood as constituting – a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our site content. We do not provide personalized recommendations or views as to whether a stock or investment approach is suited to the financial needs of a specific individual.

Tags

AphriaCanopy Growth Corp.Charles MoonCronosMarijuana Newsmarijuana stocksProsper TradingProsper Trading Academy