Patented Pot: A Multimillion-Dollar Battle Looms

Encouraged by the opening of legal markets in the various medical and recreational states, the cannabis industry has seen a surge of intellectual-property activity over the past 15 years. Nearly 400 patents have been filed with the US Patent and Trademark Office (USPTO) with keywords like “cannabis,” “marijuana,” “CBD” and “THC.” Thus far, the patents range from new strains and novel extracts to recipes for cannabis-infused alcohol and the use of cannabinoids for the treatment of epilepsy.

While the USPTO can issue patents for such, the plant’s illegality under the Controlled Substances Act makes these patents difficult to enforce in federal courts.

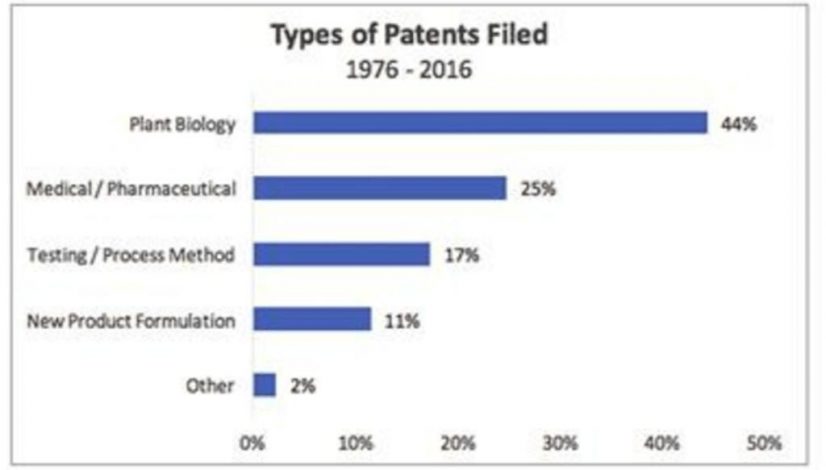

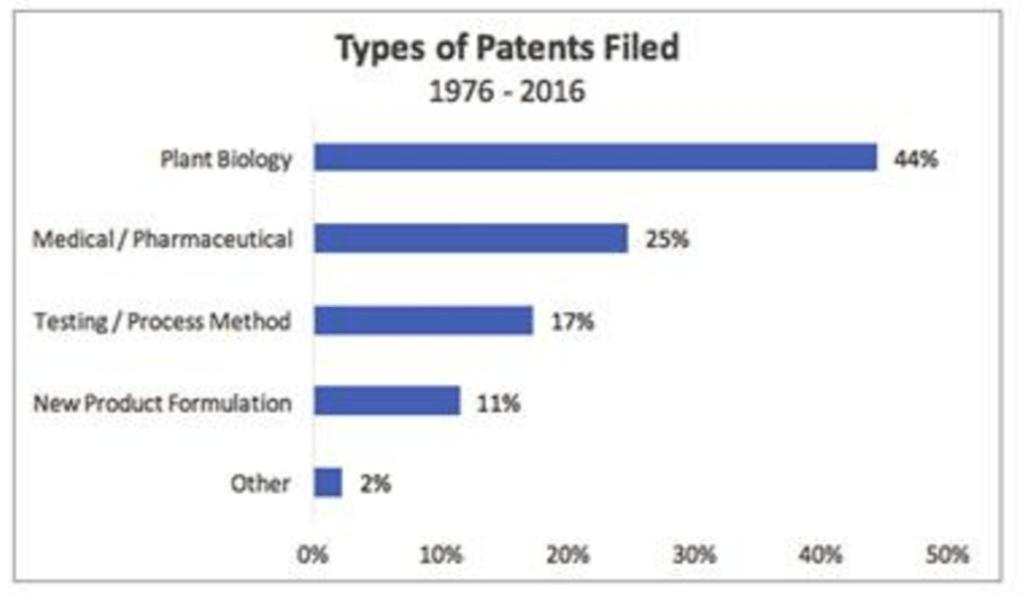

Nevertheless, speculators are anticipating the vast and hugely profitable opportunities to be had once cannabis becomes legal nationally. Cannabis-related patents began to increase in the mid-1990s before peaking in the late 2000s. In New Frontier Data’s Cannabis Industry Annual Report: 2017 Legal Marijuana Outlook, these patents are separated into five categories: plant biology, medical/pharmaceutical applications, testing/process methods, new product formulations, and other.

Since 1976, most cannabis-related patents fell within the categories of plant biology (44%) or medical/pharmaceutical applications (25%). Since 2014, however, with the advent of adult-use markets in the recreational states, the number of patents issued for testing/process methods and new product formulations have increased, reflecting both the growing sophistication of the industry and an increased recognition of the value in intellectual-property rights.

While the protection of intellectual-property assets is understandable, some patents have the potential to be highly disruptive to the industry, particularly three filed by a single company, the Biotech Institute in Westlake Village, California. Biotech’s Patent US 9095554 was granted in 2015 as the first-ever marijuana-breeding-related patent. The summary abstract (part of a 140-plus-page application) states: “The invention provides compositions and methods for the breeding, production, processing and use of specialty cannabis.” Along with its Patent US 9370164, Biotech’s rights could cover 50 to 70 percent of all strains on the market, given that most cannabis plants currently grown fall within the THC, CBD and terpene ratio specifications outlined in those patents.

Bottom line? If they’re enforced, any grower whose strain matches the characteristics covered by Biotech’s patents could be legally forced to stop growing it, or be subject to royalty payments to the patent holder.

A third one pending, Patent US 20150366154, also from the Biotech Institute, covers propyl and “varin” cannabinoids, which are notable for their potential effectiveness in a range of therapeutic applications, including treatments for obesity, epilepsy and Parkinson’s disease.

Collectively, these patents could be massively disruptive to the industry, spurring significant legal challenges, increasing the costs of doing business, and ultimately stifling innovation. With additional patents filed in Europe, the Biotech Institute may be aiming to accumulate worldwide rights to a large swath of the cannabis-plant ecosystem in both the US and international markets.

How the cannabis industry responds to Biotech’s patents (and other, similar patents that may be overly broad in covering cannabis plants and plant derivatives from processes that have been available for years prior to the patent applications) will be crucial in shaping the industry’s future. Challenging the patents through conventional channels in the USPTO could cost upwards of $1 million in legal fees alone. Should such challenges be pursued in the courts, the estimated costs could scale upwards of $5 million.

The ability to mount a robust legal challenge to such overly broad patents may require a pooling of resources by many cannabis companies, or engaging a legal-defense advocacy group willing to file challenges on a pro bono basis. Even then, such a case could take years of litigation, which means that anyone mounting a challenge should plan for a multiyear effort to determine who will collect the spoils in an industry potentially worth billions.

You can keep up with all of HIGH TIMES’ marijuana news right here.