Cannabis Illicit Market Shrinking, New DEA, Homeland Security Numbers Suggest

There are no completely accurate methods to measure the size of illicit markets, no matter what is being bought and sold. There are, however, some figures that can be taken as proxies of these markets. In the case of cannabis, it could be argued that seizures and confiscations can be, in a way, interpreted as surrogates of the actual illicit market sales.

Now, while establishing a univocal multiple to convert confiscations into actual sales is really hard, seizure figures can help us better understand the direction of the illegal markets: are they growing or shrinking? At what pace?

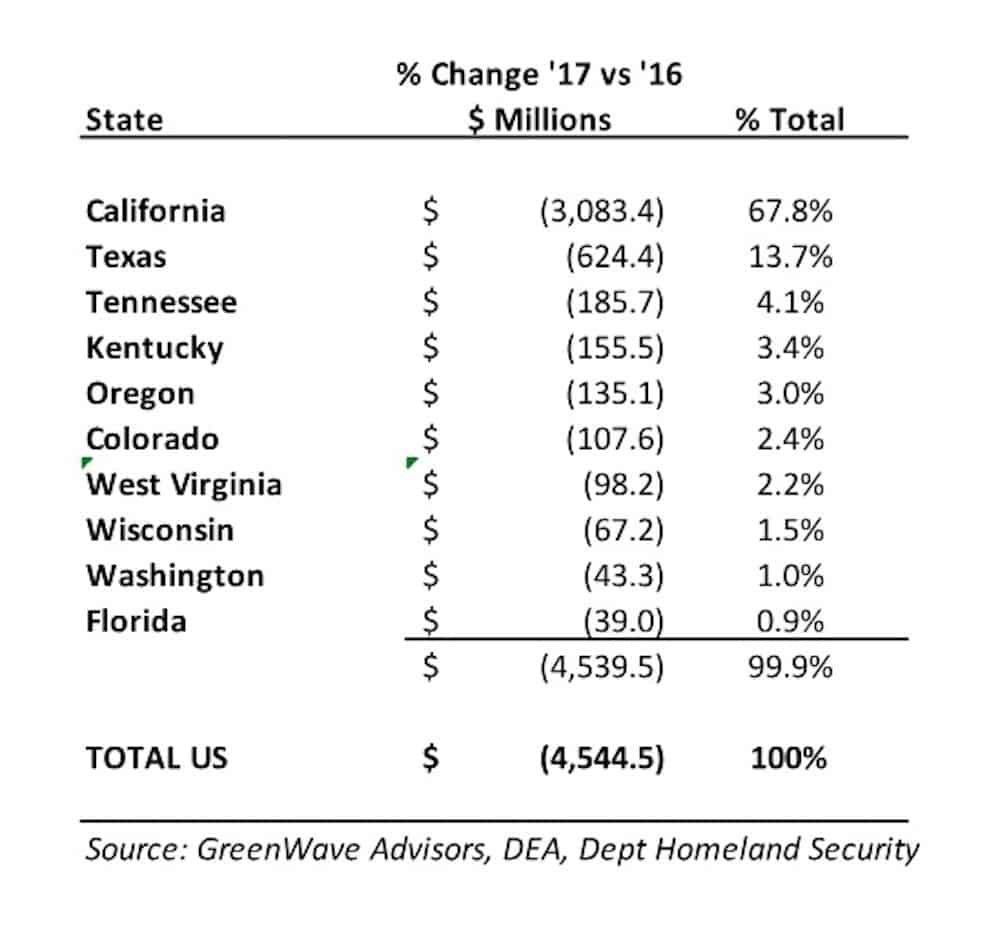

To help us figure this out, GreenWave Advisors shared some exclusive data based on reports from the DEA and the U.S. Department of Homeland Security with High Times.

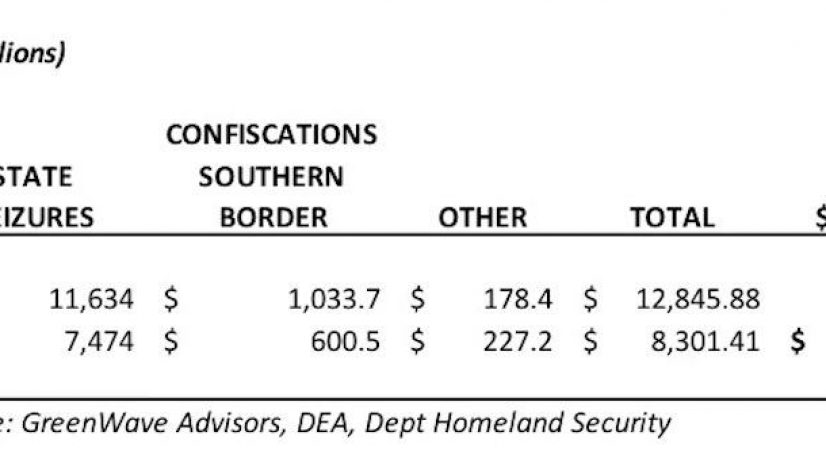

Courtesy of Greenwave Advisors, Dept. of Homeland Security, DEA

For reference, GreenWave estimates that last year cannabis sales hit $8.2 billion, with California boasting a 34 percent market share.

As it can be appreciated above, total confiscations (as measured in U.S. dollars) declined by 35 percent from 2016 to 2017, signaling a similar drop in illicit market marijuana sales over last year – and an even larger drop when compared to previous years.

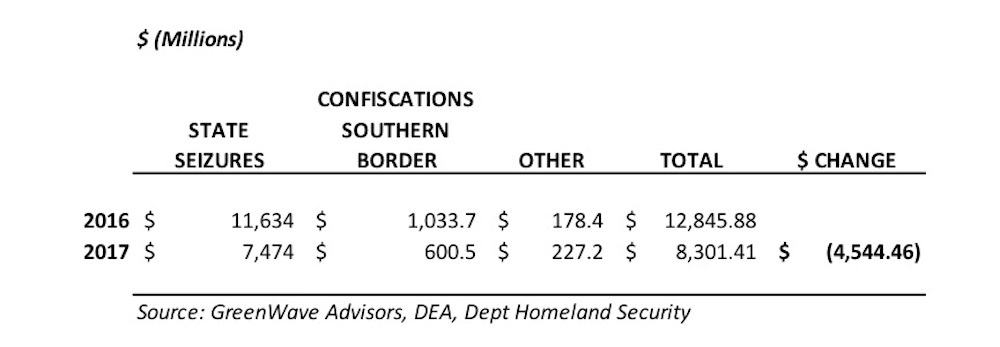

Courtesy of US Border Patrol, DEA

However, it’s important to notice that confiscations can relate to different phenomena. The decline can be interpreted:

- As a signal of a reduction of illegal cannabis production and sales.

- As a reflection of a reduced interest by the DEA and other agencies to prosecute the illegal cannabis trade.

- As a proxy of a decline in the efficiency or efficacy of said law enforcement agencies.

- As a sign of the surging impediments and hurdles these federal agencies face as more states legalize weed.

The Methodology

Taking the points above into account, we decided to ask GreenWave Advisors’ founder and managing partner Matt Karnes about his methodology, and then reach out to other experts for commentary on its validity.

“It is very difficult to quantify with precision just how large the black market is and moreover, to what extent it is contracting,” Karnes told High Times. “In order to determine a baseline, we analyzed plant confiscations by state as disclosed by the DEA in its annual report as well as marijuana seizures reported along the southern border by Homeland Security.

“The decline in overall activity could very well be attributed to an enforcement protocol that is more lax than in years past as provisions in the federal budget preclude the deployment of resources to shut down legal pot businesses… But the key is LEGAL businesses so, in theory, illegal markets should continue to feel pressure from fed intervention.”

As Karnes explained, GreenWave converted the number of plants to pounds, and then, these pounds to fair values at retail, based upon industry averages for both indoor and outdoor grows.

Dustin Moore has a long trajectory in the policy and cannabis spaces. He was the Deputy Campaign Manager for Proposition 64, the statewide ballot initiative that legalized the adult use of marijuana in California. He now serves as the Executive Director of the International Cannabis Farmers Association and as the Principal at strategic consulting and government affairs firm Main Street Strategies.

Decided to not influence his answer, we asked what he thought about GreenWave’s information.

His first instinct was to question the use of the term “black market”.

“There’s obviously a disproportionate number of folks that were impacted by the War on Drugs – people of color. So, by attributing the word ‘black’ to illegal markets, what we do is further perpetuate that. So, I’d say there are illicit markets, unlicensed markets, and the legal markets – which equate to black, grey and white markets in the old slang.

“While the DEA focuses mostly on illegal market players, I’d say in California the unlicensed players represent the most predominant section of the market right now,” he added, quoting the complex legislation and conflicting regulations.

Having said this, he classified the data set in this article as “probably the most concrete set of data points that you can use… The hardest thing to do is to try and develop causality of why the illegal markets seem to be shrinking. Is it because there are now roughly 30 states with legal cannabis? Is it a function of the DEA and homeland security not prioritizing cannabis as much as they once did, given the fact that the Rohrabacher–Farr amendment gives them less latitude than what they once had?

“Nobody is going to get these estimates perfectly, but this is the more accurate interpretation I’ve seen,” Moore said.

Contrasting The Data

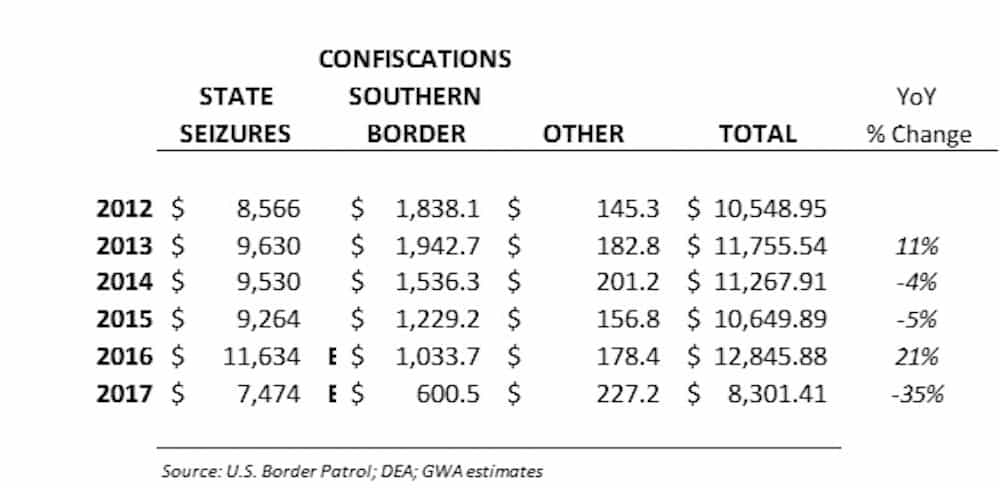

Interested in what other experts had to say about this, we reached out to Jonathan Rubin, CEO of New Leaf Data Services, and walked him through the data. In his opinion, the direction things seem to be moving makes sense. “Declining wholesale prices in the most mature, competitive markets should encourage more legal buying,” he said.

“While legal cannabis will nearly always incur higher productions costs due to regulatory compliance (from testing and packaging requirements to license fees and taxes), the dramatic price erosion witnessed over the past few years makes legal supplies more price competitive with the black market. As illustrated in the chart below, the U.S. Spot Index, which tracks the national wholesale price, has declined 35% since the beginning of 2016,” he added.

Courtesy of New Leaf Data Services

State By State

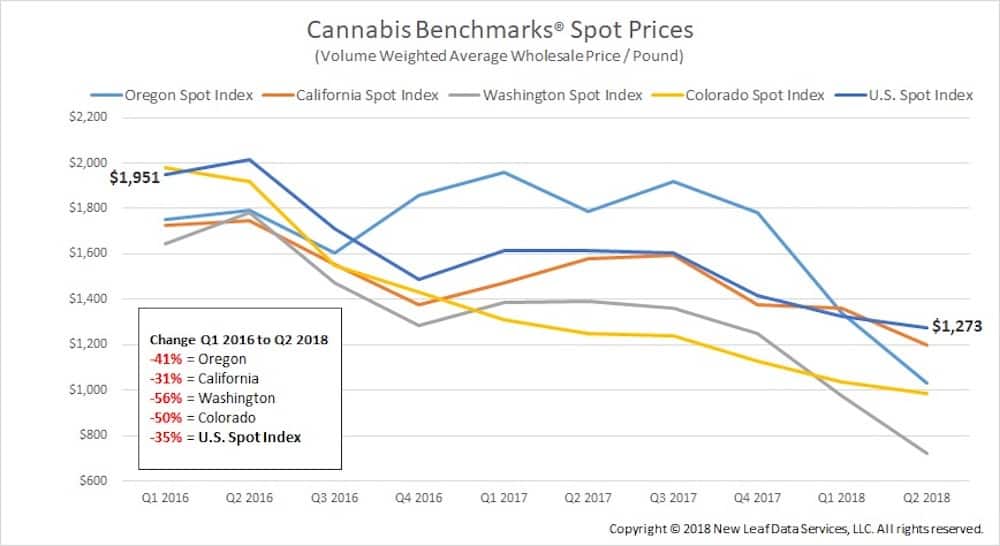

The chart below looks at the states that saw the largest declines in confiscations. It should be noted that, while California experienced the largest decay, these numbers only reflect the plants and buds confiscated within the state’s limits. However, California’s illegal producers supply a large amount of the illegal weed consumed in many other U.S. states.

“Also, the wildfires in California last year could have impacted the reduction in plant seizures,” Karnes warned.

Courtesy of Greenwave Advisors, Dept. Homeland Security, DEA

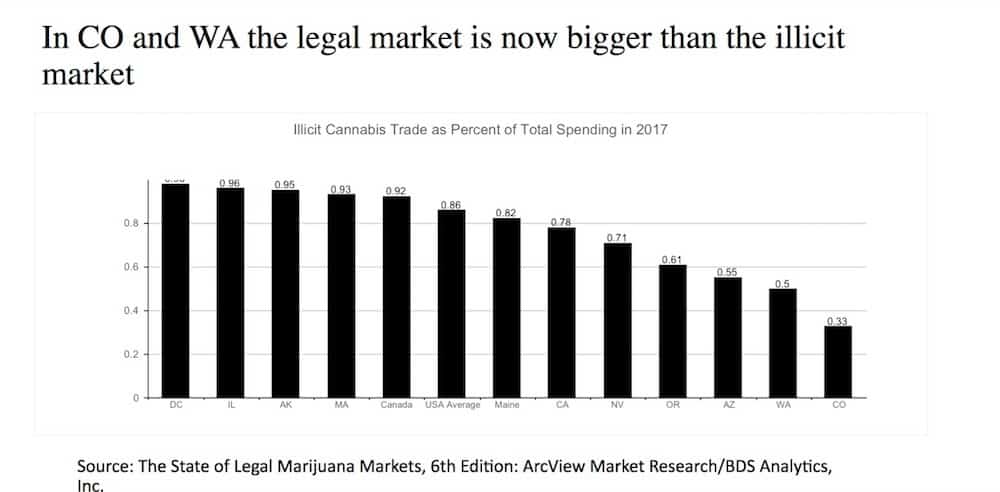

Finally, for context and comparison, see BDS Analytics’ estimates for 2017. As it can be appreciated, black market sales accounted for only 1/3 of sales in Colorado, and half of sales in Washington.

Courtesy of BDS Analytics

By means of conclusion, we’d like to quote a paragraph from the report “The State of Legal Marijuana Markets,” published by BDS Analytics and the ArcView Group.

“The successful reduction of the illicit markets in Colorado, Washington, and Oregon provides evidence that legalization works, and continues to support the assertion that ‘more legalization is better.’ Colorado has been most successful, licensed most liberally, and taxed the least; its legal market has grown the most and done the most damage to the illicit market. With the addition of California and Canada to the ranks of adult-use markets, it can now be expected that the overall North American illicit market will continuously decline throughout the forecast period and beyond,” it reads.

“The conclusion I draw from all of this is: draw your own conclusion,” Moore added. “However, these facts point to one of the four potential outcomes mentioned above.”

The post Cannabis Illicit Market Shrinking, New DEA, Homeland Security Numbers Suggest appeared first on High Times.