A Closer Look At One of the Smaller Cannabis Stocks: INVICTUS MD STRATEGIES CORP.

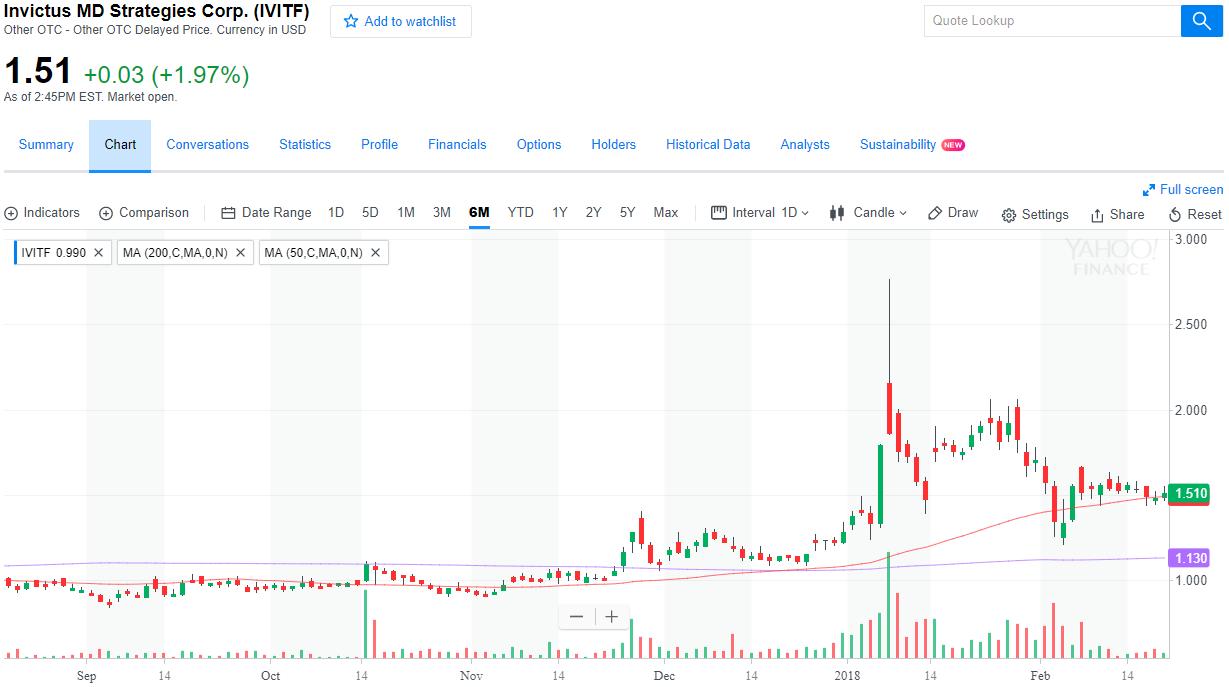

Invictus MD Strategies Corp. (TSXV: IMH) (OTC: IVITF) is what is referred to as a micro-cap stock with a market capitalization of under $300 million. Currently Invictus has a market capitalization of $134.506 million in the over-the-counter market. These small companies are very tricky to invest in and can be very volatile, but at the same time some of the most undervalued stocks out there are micro-caps. IVTF, the OTC ticker symbol trading in U.S. dollars, is trading around $1.51/share. In the U.S. regulated market Invictus would likely be listed as a pink sheet. Let’s take a look a what Invictus has been doing and why they may be an undervalued stock.

Dan Kriznic, CEO of Invictus Seated in the Middle

Dan Kriznic, CEO of Invictus Seated in the Middle

Invictus is run by Dan Kriznic who is a certified public account, with ten years of experience in the field in the early part of his career, and later became the CFO for a private education investment group out of Vancouver. To me, that is the sort of experience that knows how to focus on cash flows and understands the organization it takes to run a publicly traded company. If we take the next step and explore the business plan of Invictus, we will see even more evidence of strong organization.

Acreage Pharms Phase 2 Expansion

Acreage Pharms Phase 2 Expansion

In April of 2017, Invictus purchased an Access to Cannabis for Medicinal Purposes Regulations (ACMPR) greenhouse company called Acreage Pharms in Alberta, and then began a very ambitious expansion project. In early February Invictus purchased 50% of AB Laboratories, another ACMPR company, in Ontario. Phase 2 of the expansion of Acreage Pharms is nearing completion and phase 3 is expected to begin soon. On top of that, Invictus just sent out a press release concerning the acquisition of 23 new strains of marijuana.

“The acquisition of these strains broadens Acreage Pharms strain variety in preparation for the recreational market,” said Dan Kriznic, Chairman and CEO of Invictus. “The timing is ideal, as our Phase 2 expansion includes 11 new flowering rooms, all of which will be needed to accommodate this welcome and dramatic expansion of strains.”

This is a significant business plan that puts Invictus in a good place to become a major player in the Canadian cannabis market.

When looking at this chart first you will notice how youthful the company is and how it just left the realm of penny stocks. Like most of the cannabis industry, it took a hit when the market sold off recently. However, when you look at the strong fundamentals behind this company, there seems to be a very strong foundation with good leadership and a solid business plan. I have never much believed in the idea of buying on dips, except for instances when the dip happens in a well run company that has a product in strong demand. Micro-cap stocks are always a risk, but keep reading their most recent press release and decide for yourself if this is a dip that has actually undervalued Invictus.

The collaboration allows Acreage Pharms to import genetics, including seed and starting material. As a result, Acreage Pharms’ already innovative and ambitious genetics breeding program is better able to offer a variety of strains that fully reflect the genetic diversity of cannabis, including its many health-enhancing properties. Once the new strains arrive at Acreage Pharms, in approximately 10 days, Acreage Pharms will begin creating and selecting specific genomes for production for medical and recreational use.

Production in the Phase 2 facility will reach 5,000 kg cannabis production per year. Phases 1 and 2 represent 40,000 square feet of growing space, and Phase 3 — which due to excellent progress on Phase 2 construction is on track for 2018 completion — will add another 80,000 square feet to Acreage Pharms canopy. The combined projects are projected to allow Acreage Pharms to produce 19,000 kg in 2018.

read more at prnewswire.com

Facebook Comments

Tags

AB LabratoriesACMPRAcreage PharmsDan KriznicInvictus MD Strategies Corp.micro-cap stock