The Cannabis Cryptocurrency Phenomenon

You may have heard that there is a real marijuana banking problem since cannabis is still a Schedule 1 drug. Banks are not interested in accepting funds from cannabis businesses or in facilitating purchase transactions for state legal marijuana businesses. The cannabis industry is desperately looking for a solution and many are looking to a cannabis cryptocurrency remedy instead of keeping their cash buried in the back yard.

The markets are booming these days and there are some real leaders in the charge up, including marijuana and cryptocurrency companies. The S&P 500 and Dow Jones hit all-time highs at the end of November. The CME is even going to launch a bitcoin futures contract later this month considering there is so much interest in the market.

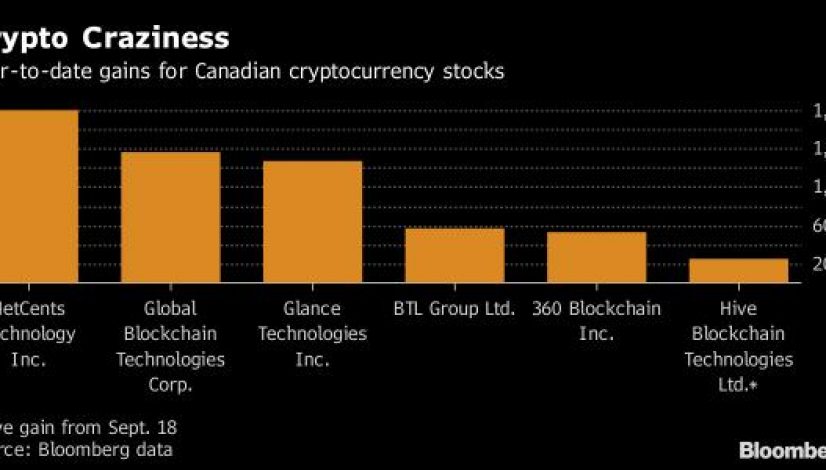

Little-known Canadian stocks such as Hive Blockchain Technologies Ltd., Glance Technologies Inc., and NetCents Technology Inc. have surged as much as 20-fold this year, giving retail investors a way to embrace the mania without actually having to buy bitcoins.

The country counts at least eight cryptocurrency-related stocks with a market value totaling about C$2 billion ($1.6 billion), making it a burgeoning hub for bitcoin listings. And there may be more ways to invest soon: At least two Canadian firms have filed to launch what could be among the first bitcoin exchange-traded funds.

Canada’s stock markets are no strangers to investing fads, with cobalt, lithium and marijuana stocks all bubbling higher this year. The country’s TSX Venture Exchange has been dubbed the “wild west,” the penny stocks among its more than 1,700 listings gyrating wildly from one day to the next.

Cryptocurrency experts say the fast-evolving bitcoin sector is a classic case of buyer beware, not unlike the dot-com bubble of the late 1990s when shares would spike in value simply because a company had “.com” in its name. Bitcoin, one of several digital currencies, briefly topped $11,000 on Nov. 29 and was trading at about $10,780 on Friday, up roughly 11-fold this year.

Toronto-based Evolve Funds Group Inc. and Purpose Investments Inc. hope to do just that. They’ve recently filed regulatory documents to launch ETFs based on the bitcoin futures contracts that will begin trading Dec. 18 on the Chicago Mercantile Exchange. Horizons ETFs Management Canada Inc. is also “interested in creating an ETF that would give investors multiple types of exposure to bitcoin,” co-Chief Executive Officer Steve Hawkins said in an email.

There are many elements to consider when looking at the market here near its all-time high. Consider the strong interest in the economic potential of legalized marijuana, a possible financial remedy in cannabis cryptocurrency, (which is also technologically dazzling to a point that few truly understand it) and also think of a “Santa Claus Rally”. If you combine those three elements with an already super leveraged overall market, does suggesting the market is overbought here seem that ridiculous?

read more at bloomberg.com

Enjoyed?

Leave your Feelback!