Colorado’s bank commissioner who dreamed up cannabis banking solution steps down

Published: Oct 31, 2017, 10:49 am • Updated: Oct 31, 2017, 1:37 pm

By Jesse Paul, The Denver Post

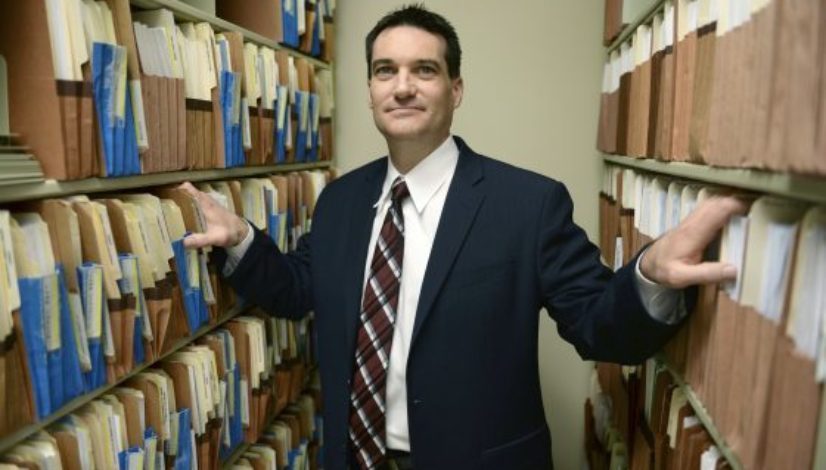

Chris Myklebust, the state bank and financial services commissioner who dreamed up a pot-banking workaround for Colorado, is leaving his job at the end of next month, joining a growing list of Gov. John Hickenlooper’s top administrators who are vacating their posts.

The Department of Regulatory Agencies, in announcing Myklebust’s departure, did not say what’s next for the man who spent more than a decade regulating state financial institutions.

DORA spokeswoman Rebecca Laurie said he “is pursuing his own business.”

Myklebust was was appointed as Colorado’s State Bank Commissioner in July 2015. He served as state’s commissioner of financial services from 2006 to 2015.

“Chris has been an outstanding asset not only for the Department of Regulatory Agencies, but also for the people of Colorado,” DORA executive director Marguerite Salazar said in a written statement. “We will all miss his passion and expertise to engage industry stakeholders while managing a balanced regulatory environment, as well as his commitment to consumer protection and public service.”

Myklebust, in a statement, said he was departing to “pursue other passions.”

Related stories

- Cannabis equity fund seeks to raise record-breaking $250 million

- Crowdfunding site shuts down campaign for California cannabis farm fire victims

- Some cannabis farmers’ livelihoods could be wiped out by California fires

- Uruguay setting up dedicated cannabis dispensaries after banks scare off pharmacies

- Hawaii to be first state where all cannabis dispensaries provide cashless sales

“I leave knowing that I accomplished what I set out to do, which was to streamline regulatory processes by removing unnecessary red tape so our licensees remain healthy and competitive, as well as help consumers understand their financial rights and engage them in opportunities to improve their personal financial literacy,” he said.

Myklebust’s brainchild was a way for legal marijuana businesses in Colorado to do business with banks so they had a place to deposit their all-cash revenue. Federal officials opted not to play ball, however, denying a master account number that would have given a cannabis-focused credit union access to the federal banking system.

DORA deputy executive director Patty Salazar and deputy state bank commissioner Ken Boldt have been appointed to fill Myklebust’s roles in the interim.

Myklebust is the fourth ranking member of Hickenlooper’s administration to depart in the past five weeks.

On Monday, the state announced Sue Birch, executive director of the Department of Health Care Policy and Financing, will officially end her tenure next month to take a position as the Health Care Authority director for Washington state.

Last week, Shailen Bhatt, executive director of the Colorado Department of Transportation, announced he will be stepping down from his job in December. Late last month, Ellen Golombek said she would leave her post as executive director of the Department of Labor and Employment to take a post with a national workforce advocacy agency.

In August, Barbara Brohl left her job leading the Colorado Department of Revenue. In June, Joe Neguse stepped down from his position as executive director of the Department of Regulatory Agencies to run for Congress.

The high-level departures from Hickenlooper’s administration pose a distraction for Hickenlooper’s administration as the governor, who is term limited, works to accomplish long-standing goals before leaving office next year.

Topics: banking, Chris Myklebust, Colorado