The Bloom Is Off the Rose for Flower’s Popularity

Despite the burgeoning demand for legal cannabis, whether for medical or adult use, trying to make money from it remains a tricky proposition. Its unique semi-legal status (tax code 280E), plus the challenges of branding and differentiating when advertising opportunities are limited, all conspire against entrepreneurs, and dispensary owners in particular. Enter Baker, a Denver-based software company that helps more than 300 dispensaries in 10 states through its smart applications for online ordering, customer retention and personalized messaging.

Through a research partnership, New Frontier Data has been able to gauge online ordering habits and loyalty data collected by Baker in key US markets, including California, Oregon, Colorado, New Mexico and Washington, as well as the Canadian provinces of Ontario and British Columbia. Notably, these data include the demographics of those consumers who account for 80 percent of the dispensaries’ overall revenue and represent the “power users”—i.e., the most influential group in driving demand and shaping consumer trends.

Among the trends noted in New Frontier Data’s recent “Cannabis Industry Annual Report: 2017 Legal Marijuana Outlook” is the declining relative popularity of flower against other product types. Certainly, cannabis flower remains the single largest source of revenue for dispensaries. In medical markets, for example, flower makes up 47 percent of total sales volume, but it accounts for 71 percent of total revenue generated. In contrast, pre-rolled joints account for 13 percent of total sales volume but only 2 percent of total revenue.

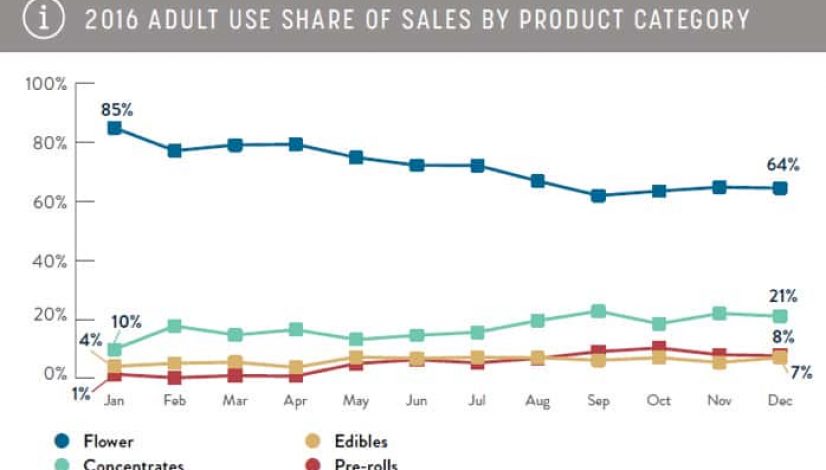

Even so, the fact is that non-flower products are eroding flower’s share of the market. In both the medical and adult-use markets, the share of flower sales fell from nearly 90 percent in early 2016 to just under 65 percent by year’s end. The decline was different in both markets: For medical use, the demand for concentrates grew from 10 percent to 27 percent of sales by year’s end, whereas for adult use, concentrates only grew to 21 percent. Yet the demand for pre-rolls among adult-use consumers grew significantly, from 1 percent to 8 percent of sales. In the medical market, pre-rolls accounted for only 2 percent of sales by year’s end.

Concentrates are expected to continue to erode flower’s market share throughout 2017, with the trend more pronounced in the medical market. In the adult-use market, pre-rolls are expected to continue to perform well as the quality of flower in them improves, and as more producers create distinct pre-roll brands with high-quality packaging and wide choices in flower types.

Also, adult-use consumers were far more likely than medical patients to purchase flower in ⅛ oz packages (61 percent versus 39 percent), while medical patients were more likely to purchase 1 oz packages than adult-use consumers (19 percent versus 2 percent). Those patterns signal differences in how medical and adult-use consumers prefer to purchase their cannabis: Patients using specific phenotypes to address a medical condition are more likely to purchase large quantities and to order more regularly that adult-use consumers. Conversely, adult-use consumers preferred to buy in smaller quantities, giving them the flexibility to try out a range of different strains and to tailor their purchases to reflect various desired outcomes or experiences.

With flower’s share of the market continuing to decline, concentrates are now the second-largest category among both types of consumer, while pre-rolls are experiencing far stronger growth in the adult-use market.

As the legal cannabis industry grows, variety remains the spice of life—as well as the key to success.

RELATED: August 2017 Pot Prices

For all of HIGH TIMES’ cannabusiness coverage, click here.