Meet the First Cannabusiness to Be Accepted into Johnson & Johnson’s Innovation Lab

Photo by Javier Hasse.

This article was originally published on Benzinga, and adapted exclusively for HIGH TIMES.

As a cannabis company, Avicanna did not know what the outcome would be when applying to be part of JLABS @ Toronto. Yet, they were decided to make it, CEO Aras Azadian and LATAM VP Lucas Nosiglia told Benzinga in a recent interview.

A few things became clear early on in our chat.

First, these guys know about entrepreneurship and overcoming adversity; this is not their first (nor second) successful venture. Second, they understand the value of what CanopyBoulder’s Micah Tapman recently defined as “authentic relationships” for success. Third, one can accomplish big things with relatively little money.

The story of how Avicanna was accepted into JLABS @ Toronto starts with Azadian and Dr. Justin Grant, PhD, MBA, a member of the former’s Scientific Advisory Board and the research program manager of the STTARR Innovation Centre with Princess Margaret Cancer Centre at the University Health Network, the largest cancer center in Canada. The idea of approaching JLABS @ Toronto popped up during a conversation between the two; although it seemed like a long shot, they went for it. They really trusted their vision.

As background, Johnson & Johnson Innovation, JLABS @ Toronto is a 40,000 square-foot life science innovation center located in MaRS Discovery District. The labs provide a flexible environment for start-up companies pursuing new technologies and research platforms to advance medical care. Through a “no strings attached” model, Johnson & Johnson Innovation does not take an equity stake in the companies occupying JLABS, and the companies are free to develop products—either on their own, or by initiating a separate external partnership with Johnson & Johnson Innovation or any other company.

“Our first approach with them was very positive,” Azadian told Benzinga. “However, we knew they had never accepted any cannabinoid companies before.”

Azadian and his team explained that Avicanna is not just a cannabinoid company, but instead, a biotech company involved in the cannabis space—we’ll go into the products and intellectual property later in this article. Apparently, the pitch was pretty convincing, because the company made it to the first phase of interviews.

“They understood the business; they understood the approach; they understood the leveraging of different regulatory frameworks in the U.S. and Canada…”

All of this got them into another interview stage and, eventually, after several filtering instances, Avicanna was accepted to be part of JLABS @ Toronto.

“There are now currently a few cannabis-related companies incubating at our JLABS @ Toronto site, including Avicanna, which is focused on innovative approaches and technologies in the medical cannabis sector. Avicanna was selected into JLABS based on meeting the established criteria to join which includes demonstrating compelling and credible science or technology and addressing a significant medical or market need,” stated Rebecca Yu, head of JLABS Canada. “While selection into JLABS does not infer any special interests or rights in the companies, our no-strings attached model offers entrepreneurial companies and technologies the ability to access a network of resources to help reach their potential, and we’re excited to see what lies ahead for Avicanna and our other JLABS resident companies.”

Before moving on, it’s time to properly introduce Avicanna and what they do.

Coming from a biotech background, Azadian had not only an understanding of the industry, but also what he’s called an “incredible network.” So, he decided to leverage these assets and create a biotech company that was focused on cannabinoids and cannabinoid delivery mechanisms.

“What we noticed was, there is a lot of sophistication with respect to cultivation in Canada. However, due to the legal landscape, there are limitations with respect to what licensed producers can do for R&D,” he explained. “With respect to the American landscape, even though (in specific states) producers can make the products and retail them in the medicinal and/or recreational markets, there are limitations with what the federal government and the FDA will allow to be done clinically.

“There are gaps in the medical cannabis industries of the two countries that are, in my opinion, spearheading the evolution of the cannabis industry,” he added. “So, we decided to leverage off of those gaps and be a multinational company that has the R&D, the product development, clinical development capabilities, which is only enhanced by our ability—collaborate with the top medical institutions in Canada.”

One of the early steps was a strategic partnership with Scientus Pharma, a licensed dealer that allows Avicanna to address these gaps, to manufacture and clinically develop its product line.

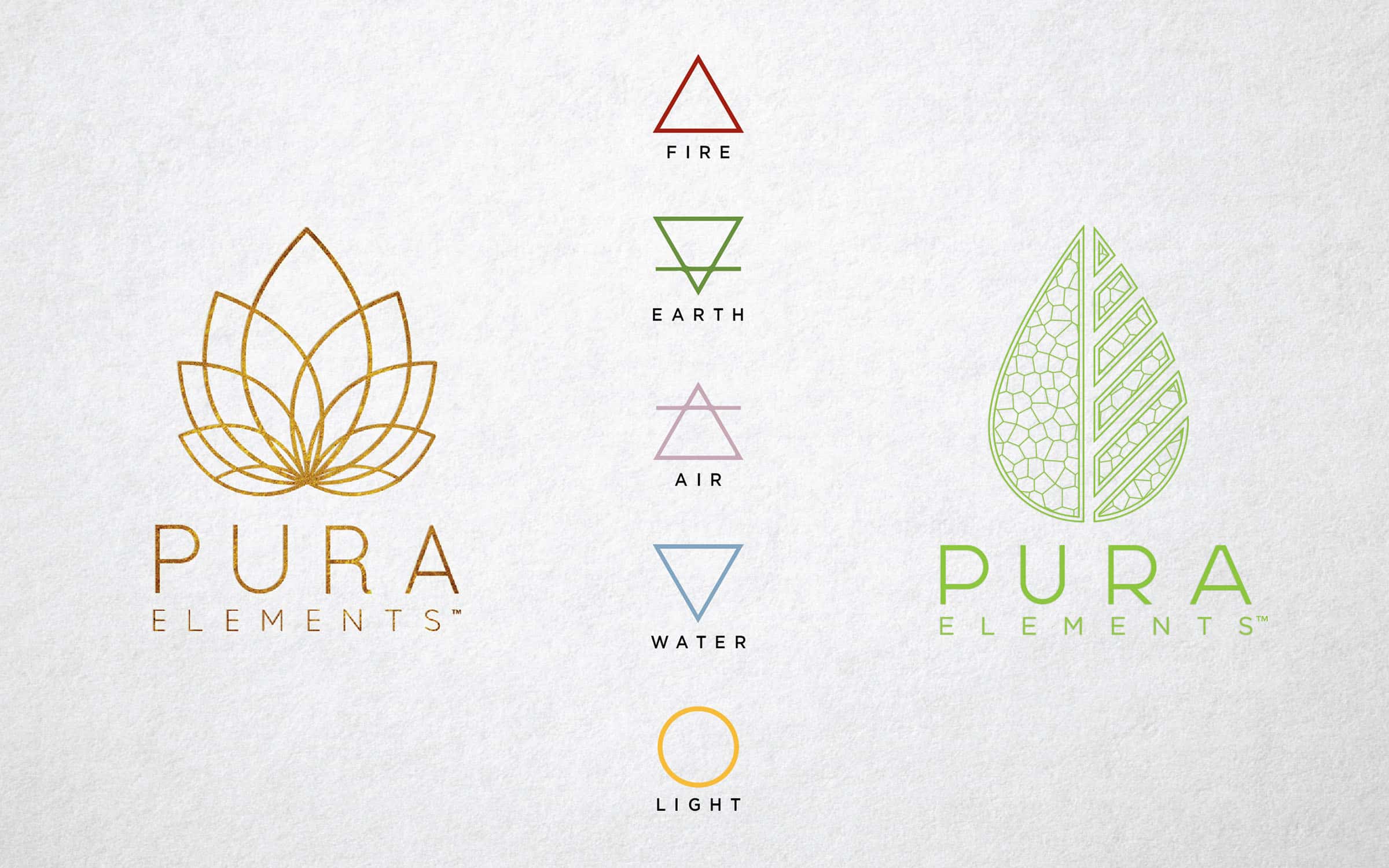

Soon after, Avicanna began developing its intellectual property for a range of transdermal delivery mechanisms including several versions of patches and creams, all with natural cannabanoids as its active ingredient. The first-generation products are now available for export and are entering the South American and European markets in late 2017 under the Pura Elements brand. Additionally, the Avicanna team is working toward approvals in their home base of Canada and expects to make its first entrance in the U.S. market by early 2018.

Photo Courtesy of Avicanna

“We are now in the clinical development phase,” Azadian continued, pointing out the company is currently conducting animal trials to understand the actual bioavailability and pharmacokinetics of the range of products that have been developed. “We are conducting a spectrum of studies including safety, toxicology, and bioavailability to better understand each particular product and help design our generation two ailment-specific products in the future.”

This is a double-sided effort.

On the one hand, Avicanna wants to prove the medical effectiveness of its products. On the other hand, they want to enhance them through diverse collaborations with scientists, research facilities and institutions. Ultimately, the idea is to develop different products, with diverse cannabinoid and release profiles, aimed at specific ailments.

Intrigued by how Avicanna’s patches, creams and tinctures work, Benzinga asked for an explanation. How long do they take to act? Do they get you high or stoned?

“The transdermal technology is an effective delivery mechanism as it avoids the first pass metabolism while avoiding smoking. Because of its slow release, the patient is avoiding an extreme surge of cannabinoids,” Azadian answered. “I personally have used the patches. I found with the THC in our 30 mg patch had minimal psychoactive effect, which was incredible because I had medical relief.”

A very important element to Avicanna’s business model and plan is international presence: they want to be early entrants in multiple nascent medical marijuana markets like Colombia, Switzerland, Germany, Spain, Chile, Brazil and Argentina.

“Since we first started with the venture, we’ve been noticing that companies, especially in Canada, are aiming at creating economies of scale for production, to prepare for the legalization of the recreational markets in 2018,” Lucas Nosiglia, who’s in charge of LATAM expansion, said. “Our model is lean and capex-low as we focus on strategic partnerships. We’ve managed to operate with our initial capital of C$1.6 million ($1.26 million) so far, leveraging our international networks to expand our footprint worldwide.”

So, what Nosiglia is working on right now is establishing the foundations to get into new markets as they roll out countrywide regulations beyond compassionate-use and exceptions in markets such as Argentina. Additionally, Avicanna has established a partnership in Colombia, which should allow them to cultivate and manufacture at a significant discount for local distribution and export.

“We decided to only raise what we needed and only tapped 40 strategic shareholders. The majority of them are investment bankers that are heavily invested in the industry or strategic investors, including ourselves—all of the founding partners have put in money as well. That was the first round,” Azadian concluded. “As we continue to progress and meet milestones, we will be visiting future financing opportunities.”

More From Benzinga:

Why Industrial Hemp Could Prove A Larger Economic Driver Than Marijuana

5 Tips To Start A Successful (And Legal) Marijuana Grow Operation, According To Serge Chistov

How Public Relations Firms Are Capitalizing On The Marijuana Green Rush

You can keep up with all of HIGH TIMES’ marijuana news right here.