GW Pharmaceuticals’ CEO talks Epidiolex, future of cannabidiol medicine

UPDATE: GW’s Epidiolex on April 19 received a unanimous recommendation from the Peripheral and Central Nervous System Drugs Advisory Committee of the U.S. Food and Drug Association. The following article has been updated to reflect that decision.

This is a make-or-break spring for GW Pharmaceuticals and its billion-dollar investment in a cannabidiol-based drug.

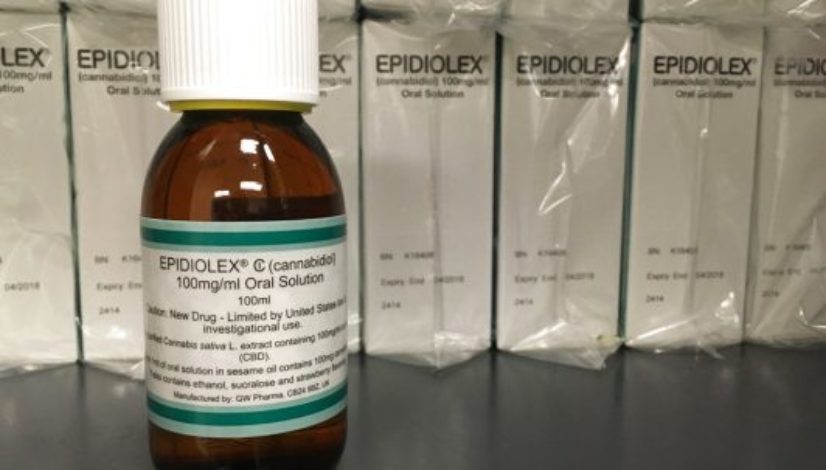

The London-based firm aims to develop the first FDA-approved medicine from plant-derived cannabis compounds. The U.S. Food and Drug Administration could decide as early as June 27 whether Epidiolex, a CBD oral solution, could be prescribed to patients with rare epilepsy conditions.

And as GW approaches that deadline, it appears the odds are in the company’s favor.

Epidiolex this week received a positive review from FDA clinicians and on Thursday received a unanimous recommendation from an FDA advisory committee. The agency isn’t obligated to follow recommendations from the clinical briefing or even the advisory committee, but positive reviews put Epiodiolex on good footing.

The Cannabist spoke with GW Pharmaceuticals CEO Justin Gover In advance of Thursday’s hearing for an update on Epidiolex’s progress, his perspective on the medicine’s potential, his views on the future for cannabinoid pharmaceuticals, and how an FDA-approved CBD drug could affect the booming business of cannabis extracts.

“We consider ourselves to be world leaders,” he said. “Our job is to stay in that position as long as we can.”

Hearing playbook

The fact that Epidolex is derived from the cannabis plant, adds a “layer of interest” that GW is prepared to address, Gover said.

Epidiolex would be a first-of-its-kind drug, so the scheduled committee hearing — in this case the Peripheral and Central Nervous System Drugs Advisory Committee hearing — was not unexpected, he said.

“(Our) focus will be on the patient population and whether this meets the standard for a new treatment,” he said.

GW’s intended to show it appropriately characterized Epidolex’s safety and efficacy; explain the level of unmet need; detail the rigor of the pre-clinical and clinical studies; and discuss the quality of the evidence, Gover said. Ultimately, GW wanted to convey its responsibility to patients 2 years of age and older who experience these rare and debilitating seizure syndromes, he said.

As Epidiolex goes, so does GW

The coming days and weeks compose a “transformative moment” for the pharmaceutical company that has been toiling away at cannabinoid research since 1998, Gover said.

“I think it’s fair to say that this product, it stands apart from the rest of our portfolio,” he said. “It is by far the most important product that we are developing today.”

GW hasn’t released pricing information for Epidiolex; however, analysts have estimated patients could pay between $30,000 to $60,000 per year if their insurance plans don’t cover the costs.

The payout for GW could be significant: Some analyst forecasts have put Epidiolex’s peak annual sales between $1 billion and $3 billion. During GW’s last fiscal year, the company generated $11 billion in revenue, mostly attributed to sales of THC-CBD Multiple Sclerosis drug Sativex, which is approved for sale in more than a dozen countries outside the U.S.

The big break for GW would be entering the U.S. market with Epidiolex and following that up with a slew of other cannabinoid-centric medicines — including Sativex, he said.

“We’re very much planning for success,” Gover said.

GW has gone all in: Gover moved to California three years ago to head the infrastructure build-out and clinical development progression for Epidiolex. The company has invested roughly a $1 billion in the yet-to-be approved medicine.

“We remain confident the drug will be approved,” he said.

And if it’s not, he added, then the question becomes, “Why is it not?”

“I find it very hard to envision a situation where we would not continue to plan on a basis of Epidiolex ultimately being approved,” he said.

Acquisition play

Questions have been raised as to whether GW will be able to successfully launch Epidiolex on its own.

A report in EP Vantage, the financial news site of biotech research firm Evaluate Group, noted that GW remains a rumored acquisition target.

“The group has been busy building its commercial team and will be targeting 4,000-5,000 doctors in the US, a big undertaking for a small company,” according to the EP Vantage report.

Gover brushes off the suggestion.

“We have the resources we need,” he said, referencing $300 million recently raised from a secondary public offering to support Epidiolex’s commercialization.

The company has the financial resources and the human resources — build-up over the last couple of years — to make sure we have epilepsy expertise throughout the organization, he said.

“Nobody knows cannabinoid science better than we do,” he said. “We’re very much going at it alone and very happy to do so.”

Crowded marketplace?

Epidiolex, if approved, won’t be the only CBD product on the market.

CBD-rich oils and extracts derived from marijuana and hemp are a big business in the U.S., totaling $367 million in sales in 2017 and projected to surpass $1.2 billion in 2022, according to Hemp Busines Journal data.

But the legality of those products is tenuous.

Sales of marijuana-derived CBD extracts are limited to respective state-legal programs. Hemp industry members and attorneys say hemp-derived CBD stands on solid legal grounds; however, federal and state agents view the products as illicit.

As Epidiolex chugs along through the FDA process, extracts makers have wondered if the medicine’s approval and eventual rescheduling will upend the booming market.

GW officials have repeatedly told The Cannabist — and even Colorado legislators — that their firm does not plan to interfere with existing hemp and marijuana businesses. Gover reiterated those stances.

“We don’t seek to intrude on other people’s business or limit other people’s business,” he said.

GW’s intent is to develop a tested and safe pharmaceutical medicine that can serve a significant unmet need — patients 2 years and older who suffer from the rare seizure conditions, Gover said.

If Epidiolex is approved, GW will continue full steam ahead on moving through its pipeline of cannabindoid therapies in addition to evaluating Epidiolex for other conditions, he said.

“Frankly, the approval of Epidiolex is almost the beginning of Chapter 2,” Gover said.